3 Point Extension is a Fibonacci pattern. It is defined by three points A, B, and C, of which:

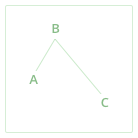

- For a bearish 3 Point Extension, points A and С are tops of the price plot, and B is a bottom between them.

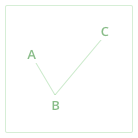

- For a bullish 3 Point Extension, points A and С are bottoms of the price plot, and B is a top between them.

- The segment AB is a retracement to the bottom followed by an uptrend segment BC.

- The price difference between A and B is about 61.8% of the price difference between C and B.

A bullish 3 Point extension is recognized if:

- The segment AB is a drive to the top followed by a downtrend segment BC.

- The price difference between B and A is about 61.8% of the price difference between B and C.

When the pattern is complete, it may suggest that the price is likely to find support or resistance at one of the Fibonacci levels calculated based on the price level of point C. Note that the Fibonacci levels are only displayed for the last Fibonacci pattern on the chart.

For educational purposes only. Not a recommendation of a specific security or investment strategy.

Technical analysis is not recommended as a sole means of investment research.

Past performance of a security or strategy does not guarantee future results or success.