Description

The Historical Volatility study calculates volatility which can be expressed by the following formula:

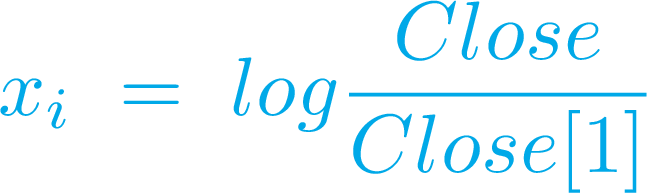

where c is a coefficient depending on the volatility basis and m is average of logarithmic return xi which, in turn, is calculated as follows:

Input Parameters

| Parameter | Description |

|---|---|

length

|

The number of bars used to calculate Historical Volatility. |

basis

|

The volatility basis. |

Plots

| Plot | Description |

|---|---|

HV

|

The Historical Volatility plot. |

Example*

*For illustrative purposes only. Not a recommendation of a specific security or investment strategy.